Legal and Policy - 6 July 2023

Description

SARS:

- 5 July 2023 – RFP07/2023: Provision of Armed Response Security and Alarm Monitoring Services

Answers to questions raised by bidders are now available.

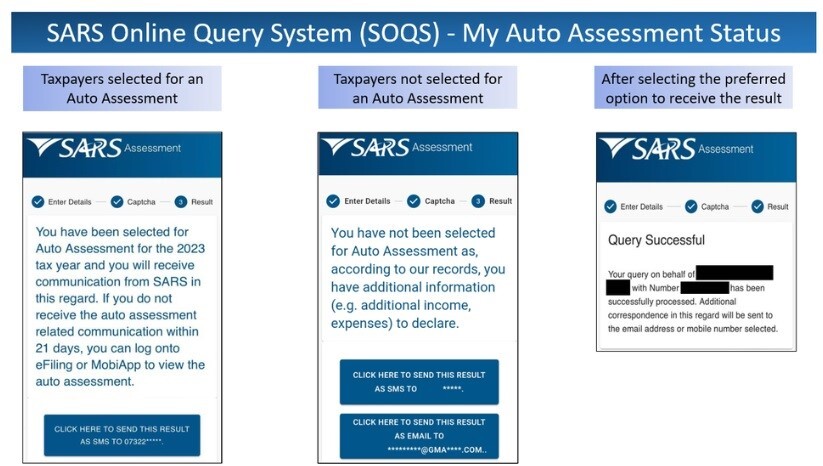

- 5 July 2023 – Personal Income Tax taxpayers who qualify for this year’s Filing Season 2023 auto-assessment can now check whether they have been auto-assessed via the SARS Online Query Service functionality, click here.

These are the various responses when you access and use this new ‘My Auto-assessment status’ query:

- 4 July 2023 – The Mobile tax unit schedules for Mpumalanga during July to September 2023 are now available.

- 4 July 2023 – Further to our communication on 29 June 2023 some additional clarification. Taxpayers with a current valid ITR-DD form do not have to get a new ITR-DD with the new form. The new form will only apply to new applicants going forward.

An updated ITR-DD form was published. The changes are cosmetic and the form is now easier to complete. The form will now have a unique number at the bottom of the page to precisely distinguish and provide reference to the taxpayer. Also the Passport number field length has been increased from 16 to 18 characters.

- For more information, see our Tax and Disability webpage.

- 3 July 2023 – The Mobile tax unit schedules for North West during July and August 2023 are now available.

- 3 July 2023 – The Mobile tax unit schedule for Kwazulu-Natal during July 2023 is now available.

- 30 June 2023 – Income Tax Act, 1962

Interpretation Note 115 (Issue 2) – Withholding tax on interest

- 30 June 2023 – Income Tax Act, 1962

Interpretation Note 6 (Issue 3) – Resident – Place of effective management (Companies)

- 30 June 2023 – Income Tax Act, 1962: Interpretation Notes

- Interpretation Note 115 – Withholding tax on interest

- Interpretation Note 6 (Issue 2) – Resident – Place of effective management (Companies)

- 30 June 2023 – Tax Administration Act, 2011: Public Notice 3631 in Government Gazette 48867 of 30 June 2023 requiring the persons specified in the Schedule to submit returns for 2024 and following years by the dates specified in the Schedule. The public notice replaces, for periods commencing on or after 1 March 2023, Notice 241 published in Government Gazette 41512 of 23 March 2018.

- 30 June 2023 – Customs and Excise Act, 1964 – Rule amendment notices as published in Government Gazette 48862 of 30 June 2023 relating to the amendments to –

- rules under sections 46, 49 and 120 – Trade agreements (DAR249) (R3620); and

- rules under section 120 – Item 202.00 of the Schedule to the rules by the substitution of forms DA 185 and DA 185.4A3 (DAR248) (R3621).

- 30 June 2023 – Customs and Excise Act, 1964

Draft amendments to Schedule No. 5 – Refunds or drawbacks of duties upon export of imported fuel

Due date for comment: 21 July 2023

- 30 June 2023 – South Africa recorded a preliminary trade balance surplus of R10.2 billion in May 2023 attributable to exports of R184.2 billion and imports of R174.0 billion.

See the Media Release here.

Visit the Trade Statistics webpage.

- 30 June 2023 – Achieving our Vision 2024 of a smart, modern SARS with unquestionable integrity that is trusted and admired is of paramount importance. Pivotal to the delivery of our vision are our digital platforms & technology infrastructure. In order to provide clarity & certainty, make it easy for taxpayers & traders to comply with their obligations and building public trust and confidence, our technology assets have to demonstrate the highest levels of availability, robustness and security.

Pursuant to our Vision and Strategic Objectives, which include modernising our systems to provide Digital and Streamlined online services, we are hard at work ensuring that our digital platforms & technology infrastructure are available, robust & secure, by performing regular upgrades, enhancements, and maintenance.

In light of the above, eFiling may be intermittently available on Saturday 1 July 2023 from 5:00 to 10:30 in the morning.

- 29 June 2023 – An updated ITR-DD form was published. The changes are cosmetic and the form is now easier to complete. The form will now have a unique number at the bottom of the page to precisely distinguish and provide reference to the taxpayer. Also the Passport number field length has been increased from 16 to 18 characters.

For more information, see our Tax and Disability webpage.

- 29 June 2023 – The Mobile tax unit schedules for Limpopo during July 2023 are now available.

- 29 June 2023 – The Mobile tax unit schedule for Western Cape during July 2023 is now available.

- 29 June 2023 – SARS will be distributing a survey to taxpayers who recently contacted SARS for assistance and decided not to continue holding for our service consultants. We would like to get your feedback to better understand your challenges and to assist SARS improve on the service offered to taxpayers. If unsure whether communication from SARS is legit, see the Current Surveys, SMSs and Emails webpage.

- 29 June 2023 – The SARS IT security team identified the following fraudulent email addresses spamming taxpayers.

If you receive an email from one of these email addresses, please delete or ignore. If in doubt, email phishing@sars.gov.za.

- ITR Service <tscompl@srs-za.com>

- ITR Audit <ntr@rmbgov.za>

- ITR Pay <audreq@eftr.co.za>

- Tax audit <audreq@eftr.co.za>

- 29 June 2023 – The Mobile tax unit schedule for Pretoria during July 2023 is now available.

- 29 June 2023 – A new scam is doing the rounds where an email titled ‘eFiling Credit Request’, is asking the email recipient to click on a link to view the amount. Please do not click on any suspicious links and delete these messages. If in doubt, always visit our Scams & Phishing webpage, where an example of this latest scam is published.

- 29 June 2023 – A new scam is doing the rounds where an email titled ‘Statement of Account request’, is asking the email recipient to download a statement of account. Please do not click on any suspicious links and delete these messages. If in doubt, always visit our Scams & Phishing webpage, where an example of this latest scam is published.

- 29 June 2023 – A new scam is doing the rounds where an email titled ‘Debt Management – Final Demand’, is asking the email recipient to download a statement of account. Please don’t click on any links and delete the email. If in doubt, always visit our Scams & Phishing webpage, where an example of this latest scam is published.

- 29 June 2023 – With reference to the unavailable message published on Tuesday, 27 June 2023. SARS is confirming that the Tax Compliance Status and related services are available on eFiling since yesterday, Wednesday 28 June 2023.

- 29 June 2023 – Tax workshop schedules for North West during July 2023 are now available.

- 29 June 2023 – Tax workshop schedules for Eastern Cape during July 2023 are now available.

- 29 June 2023 – A representative taxpayer or authorised agent that engages with SARS on an estate should adhere to the following guidelines when corresponding with SARS to prevent any unnecessary delays in finalising a query:

- Important for email queries: Always include the deceased’s ID number, tax reference number or the estate number when corresponding with SARS.

- Use of case number: When an estate is reported to SARS (via the online channels or email) a case number is provided. This case number will also be reflected on the engagement letter that is issued to the representative taxpayer once the estate is coded at SARS. Any future correspondence with SARS (via the online channel or email) should include the initial case number to ensure all queries on a case are linked.

- Uploading of supporting documents: When uploading documents, the initial case number must be used and each document must be named correctly, for example, Death certificate, ID of the deceased, ID of the executor, etc.

For more information, visit our Estates webpage or Estate Duty webpage.

- 29 June 2023 – The SC-CF-19-A02 – Facilities Code list – External Annexure was updated. The facility codes used in Box 30 on the Customs Clearance Declaration (CCD) have been updated due to:

- The name changes of:

- De-grouping depot 56 in ORTIA from Hellman to Hellmann Worldwide Logistics (Pty) Ltd.;

- Container depot K4 in Johannesburg and L2 in Port Elizabeth from Zackpack Johannesburg (Pty) Ltd. to Zacpak Johannesburg Depot (Pty) Ltd.; and

- The cancellation of de-grouping depot 67 Expeditors SA (Pty) Ltd.

This enables Customs to transmit electronic messages to these facilities communicating the status of the consignment. If the applicable facility code listed in SC-CF-19-A02 is not inserted in Box 30 on the CCD, the CCD will be rejected by Customs.

See the Registration, Licensing and Accreditation webpage for more information.

- 28 June 2023 – SARS will identify taxpayers who are married in community of property and verify this information against the Department of Home Affairs.

We have developed the following FAQs for the Married in Community Spousal Assessment, also published on the Filing Season 2023 webpage:

What are the tax implications if I am married in community of property?

Where does the amounts found on my return come from?

What should I do if I am separated from my spouse?

What should I do if I am divorced from my spouse?

What should I do if I want to exclude my spouse from communal estate due to a legal contract?

Will SARS inform the primary spouse?

Can the secondary spouse object to the ‘Married in Community Spousal Assessment’ ?

Where a match between SARS and Home Affairs is confirmed, the spouses will be linked as follows:

- If investment income is identified for a taxpayer based on third party data received (e.g. IT3(b) certificate for interested earned), the third-party data will also be prepopulated on the spouse’s return if the spouses are linked on the SARS system.

- The investment income will be apportioned accordingly and will reflect on the notice of assessment (ITA34) issued to each spouse, upon assessment.

- Note: Where applicable, the spouse who is not registered for tax may be routed for Auto Registration.

Taxpayers married in community of property may opt to exclude certain income from the communal estate. In previous tax years, one communal estate indicator displayed per applicable container/subsection of the return and if the taxpayer selected the indicator it applied to the whole income amount declared in that part of the return (e.g. total local interest or total foreign dividends)

From the 2023 year of assessment, the taxpayer can select the communal estate indicator on a transactional level (i.e. for each institution from which the income was received). This change applies to the following containers/subsections of the return:

- Local interest

- Foreign interest

- Foreign tax credits on foreign interest

- Gross foreign dividends subject to SA normal tax

- Foreign tax credits on foreign dividends

- Distributions from a Real Estate Investment Trusts (REIT) /Taxable Local Dividends

- Capital Gain/Loss

- Local Rental Income

NATIONAL TREASURY:

- Invitation for Public Comments on Draft Deposit Insurance Regulations and Accompanying Documentation – 7 June 2023

- Provisional Financing Figures as at 30 June 2023 – 4 June 2023

- Statement of the National Revenue, Expenditure and Borrowing as at 31 May 2023 – 30 June 2023

- Media statement: Tax Ombud Appointment – 30 June 2023

OECD:

- OECD launches new version of the BEPS Multilateral Convention Matching Database to further support international tax co-operation - 29 June 2023

TAX OMBUD:

- Media Statement: Minister of Finance appoints Ms Yanga Mputa – 30 June 2023

- Fairness for All: Case 24 – 30 June 2023

| Author | Legal and Policy |

|---|---|

| Date | 6 July 2023 |