Reciprocity and Affiliations

1. Recognition of other professional accounting organisations (PAOs)

SAICA recognises the need to grant membership to those members of other PAOs that meet SAICA competency requirements (defined for purposes of recognition at point of entry to the profession). Provision of this route to SAICA membership and to the right to use the designation CA(SA) is important because it :

2. Reciprocity

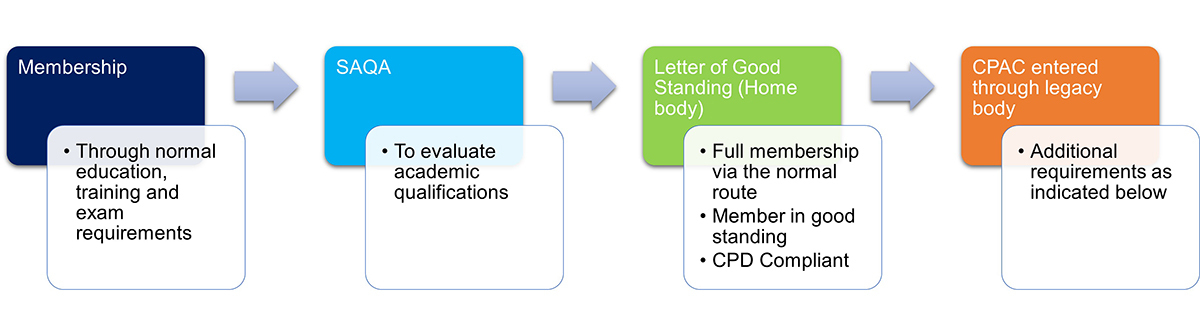

2.1 Qualifying as a CA(SA) if you are a member of another professional accountancy body

If you are a qualified member of another professional accountancy body, you may be eligible to register with the South African Institute of Chartered Accountants (SAICA) as a Chartered Accountant (South Africa) (CA(SA)). We offer various routes to membership including through:

Reciprocal Membership Agreements (RMA):

A Reciprocal Membership Agreement (RMA) is where no further professional education, training or examination requirements need to be met.

Mutual Recognition Agreements (MRA):

A Mutual Recognition Agreement (MRA) is where no further professional education, training or examination requirements need to be met.

Pathways to Membership Agreements:

A Pathways to Membership Agreement is where further professional education, training and/or examination requirements need to completed before being able to register with SAICA.

2.2 Registration of CAs(SA) with other professional bodies

As a CA(SA) you may be eligible to register as a member with a number of international accountancy bodies. These agreements are in place for membership rights only and there are usually other requirements in place for audit rights.

SAICA has agreements with the 16 bodies. We have also included, under the heading "Other Professional Bodies", information on registration requirements for CAs(SA) for a number of professional bodies with whom SAICA does not have any formal recognition agreements.

Please note the following important contact information:

How to request a letter of good standing

Please visit our member portal at https://my.saica.co.za to log your request. Once logged onto the portal, click on the menu labelled “Profile”, then look for the menu labelled "manage membership", then click on “confirm membership details”, a pop-up menu will appear where will be able to select the checkbox for "letter of good standing".

Alternatively, if you want to give special instructions (e.g. emailing letter to a third party, like NASBA/CPA Canada/CAANZ) to SAICA or attached additional documents, go to the "new queries" menu to log a new query (the area would "membership", the category would "confirm membership" and the subcategory would "Letter of good standing"). The system will issue you with an email confirming your request is received and a case will reflect as open under the "queries" menu.

If you are struggling to log onto the member portal, please send your query to ***@saica.co.za or call +27 11 621 6600.

Please note that the information presented below is correct as at 1 January 2023. Please verify the information on the relevant institute’s website.

Reciprocal Membership Agreements (RMAs) with SAICA:

Mutual Recognition Agreements (MRA):

Pathways to Membership Agreements:

2.3 Other professional bodies

3. AGA(SA) designation – Policy for the recognition of other other professional bodies

Note: There are currently no agreements in place with other professional bodies for AGAs(SA) – this is currently being explored by SAICA.

For general enquiries about qualifying as a CA(SA) if you are a member of another professional accountancy body contact ***@saica.co.za